RRP Semiconductor Ltd has become a social media sensation – imagine a stock that surges 55,000% in just 20 months! But, the focus on the world’s top-performing stock is particularly evident now, as it serves as a warning for investors seeking large returns from the artificial intelligence surge.RRP Semiconductor Ltd., previously little-known even in India, has seen the biggest global gain among companies with a market value of over $1 billion. The surge comes despite the company reporting negative revenue in its latest financial results, having only two full-time employees in its most recent annual report, and maintaining a weak connection to the semiconductor spending boom after moving away from real estate in early 2024, according to a Bloomberg report.

Why is RRP Semiconductor Ltd stock in focus?

A combination of online hype, a small free float, and India’s growing number of retail investors fueled 149 consecutive limit-up sessions, even as exchange officials and the company have warned investors. The rally is now showing signs of weakening, prompting regulators to take a closer look. The Securities and Exchange Board of India has started investigating the surge in RRP’s shares for potential misconduct, Bloomberg reported. The $1.7 billion stock, recently limited by its exchange to trading only once a week, has dropped by 6% from its peak on November 7. While RRP’s path is unlikely to significantly impact the broader AI rally that has added trillions of dollars in value to global giants like Nvidia Corp., it illustrates how extreme gains have become in certain market segments—especially in India, where the lack of listed chipmakers has left retail investors waiting for any indirect exposure to the global boom. For some, this case also highlights the challenge regulators face in protecting retail investors from speculative excess.

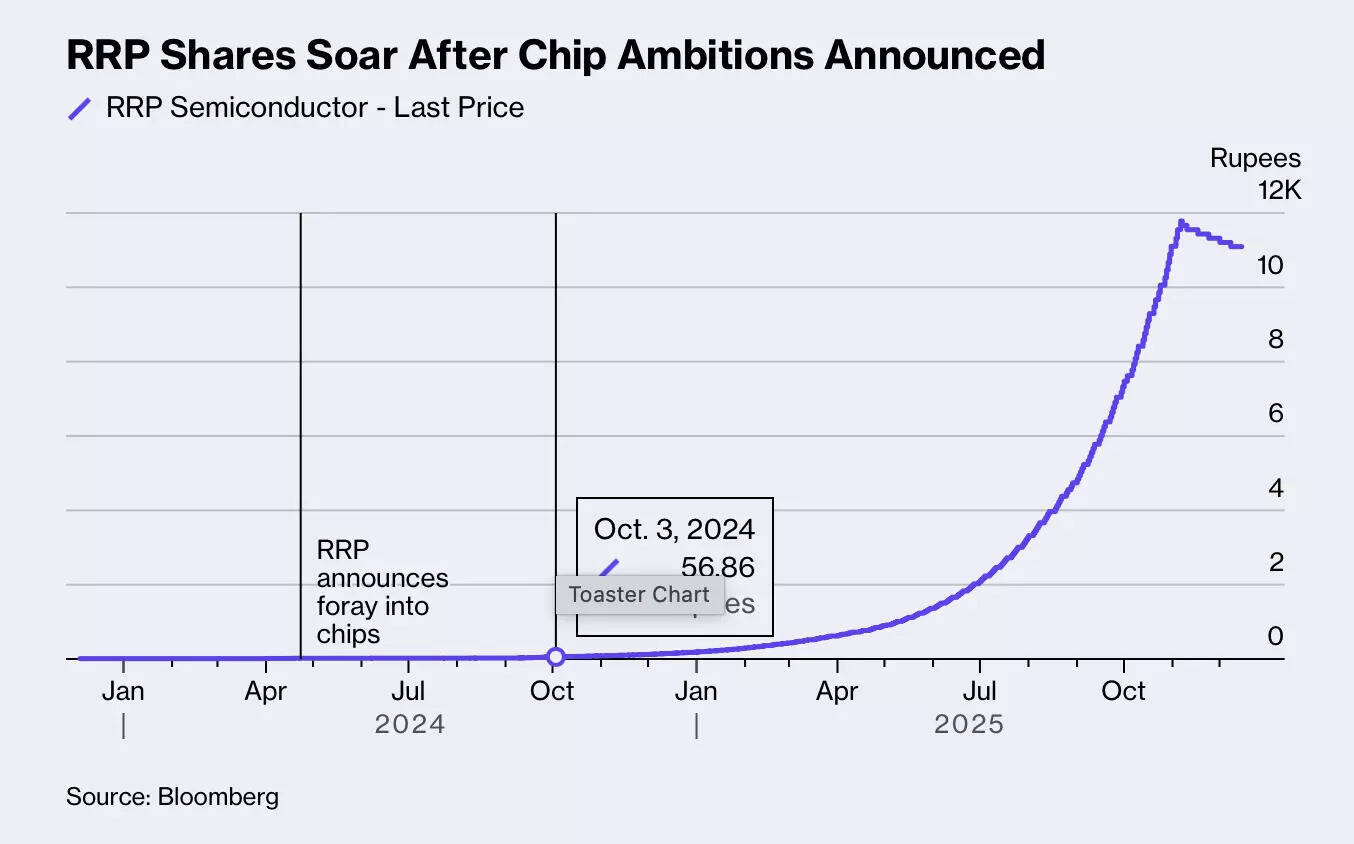

RRP shares soar after chip ambitions announced

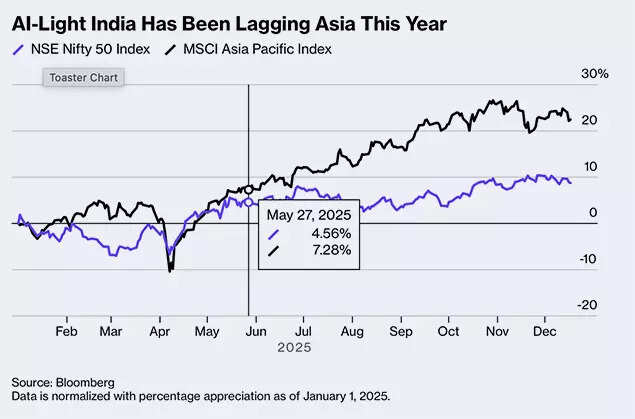

“Semiconductors have been really hot and people are willing to buy any name given India has limited stocks to offer” Sonam Srivastava, founder of Wryght Research & Capital Pvt told Bloomberg. However, with global concerns about AI valuations, situations like RRP’s suggest that investors may not be quick to invest in these stocks.In Asia, exchanges and chipmakers are cautioning investors about the risks of pursuing popular AI trades. In Shanghai, Moore Threads Technology Co., a newly listed AI-chip startup, saw a 13% drop in shares on December 12 after warning about trading risks, although the stock is still up over 500% since its debut earlier this month. In South Korea, SK Hynix Inc. saw a decline after the main exchange issued a risk alert on December 11, following a more than threefold increase in its shares in 2025.A spokesperson for BSE Ltd., where RRP is listed, said that all surveillance actions regarding the stock were communicated through market circulars. RRP’s transformation began in early 2024 when Group founder Rajendra Chodankar, known for offering niche products like thermal imaging systems and weapon-drone cameras, made a deal to take over G D Trading and Agencies Ltd. by repaying an 80 million-rupee loan for equity. On April 23, the board authorized the sale of shares to him and several others at 12 rupees each, which was 40% below the market price. This decision resulted in Chodankar acquiring 74.5% ownership, while the founders’ stake dropped to less than 2%. The company also decided to change its name to RRP Semiconductor.Two months ago, Chodankar had established RRP Electronics Pvt. to create an outsourced semiconductor assembly and testing facility in Maharashtra, a connection that may have contributed to the narrative surrounding the listed company and his private venture. At a September 2024 event for RRP Electronics’ new unit in Navi Mumbai, Chodankar stated during a media briefing: “India is going to be a superhuman, it’s established beyond doubt.” Maharashtra Chief Minister Devendra Fadnavis and cricket legend Sachin Tendulkar were also in attendance, as shown in YouTube videos posted by RRP.Prime Minister Narendra Modi’s 2021 initiative to boost the semiconductor industry — a 760 billion-rupee incentive program — has attracted $18 billion in announced investments from companies like Foxconn, Micron Technology, Tata Group, and HCL Technologies.RRP Semiconductor identifies RRP Electronics as a related party because both are owned by Chodankar, although it does not have any direct ownership stake, according to exchange filings.

AI-Light Has Been lagging Asia This Year

Despite this, some investors began to see RRP Semiconductor as a potential beneficiary of the chip industry boom. This enthusiasm overshadowed the fact that very little of its stock is actively traded: about 98% of shares are held by Chodankar and a small group of associates, many of whom are also involved in other RRP-related companies, such as RRP Defense, Indian Link Chain Manufacturers, RRP Electronics, and RRP S4E Innovation, according to filings with the BSE and the corporate affairs ministry.In April of this year, the exchange revoked approval for the company’s share sale, a decision that RRP has contested in an appeals court, with the outcome still pending. In October, it issued a warning to investors a year after placing the stock under its strictest surveillance.In September 2024, SEBI reminded the company that it was barred from accessing the securities market due to its connection with the founder group of Shree Vindhya Paper Mills. This firm was delisted by the BSE in 2017 for non-compliance, resulting in a 10-year market ban.A source told Bloomberg that BSE saw an “internal lapse” while processing the company’s offering and might seek SEBI’s advice on whether to extend the lock-in period on the shares until the appeal is settled.A BSE spokesperson noted that in RRP’s initial application, the company claimed that neither it nor its founders and directors were barred from market access, directly or indirectly. The exchange’s approval was based on this information.Since the stock rose from 20 rupees in April 2024, the company’s largest shareholder, Chodankar, stepped down from the board, and the chief financial officer resigned before returning as the company secretary. RRP also filed a police complaint against a social media influencer for allegedly spreading rumors about its supposed connections to cricketer Tendulkar and state-allocated land for chipmaking.In a November 3 exchange filing, the company stated it “has yet to start any sort of semiconductor manufacturing activities,” has not applied for any government programs, and denied any celebrity associations.The company’s financials were concerning. RRP reported a negative revenue of 68.2 million rupees and a net loss of 71.5 million rupees for the quarter ending in September. The negative revenue resulted from reversing sales recorded in the December 2024 quarter from a 4.4-billion-rupee order secured in November from Telecrown Infratech Pvt. The order was later canceled due to “contractual disagreements,” and the company also reversed 80 million rupees of revenue in the March quarter.These weak financials come at a challenging time for the stock. With the excitement around AI diminishing and regulatory scrutiny increasing, the risks now lie with investors who have invested heavily, as well as with Chodankar, who has nearly the entire stock float.