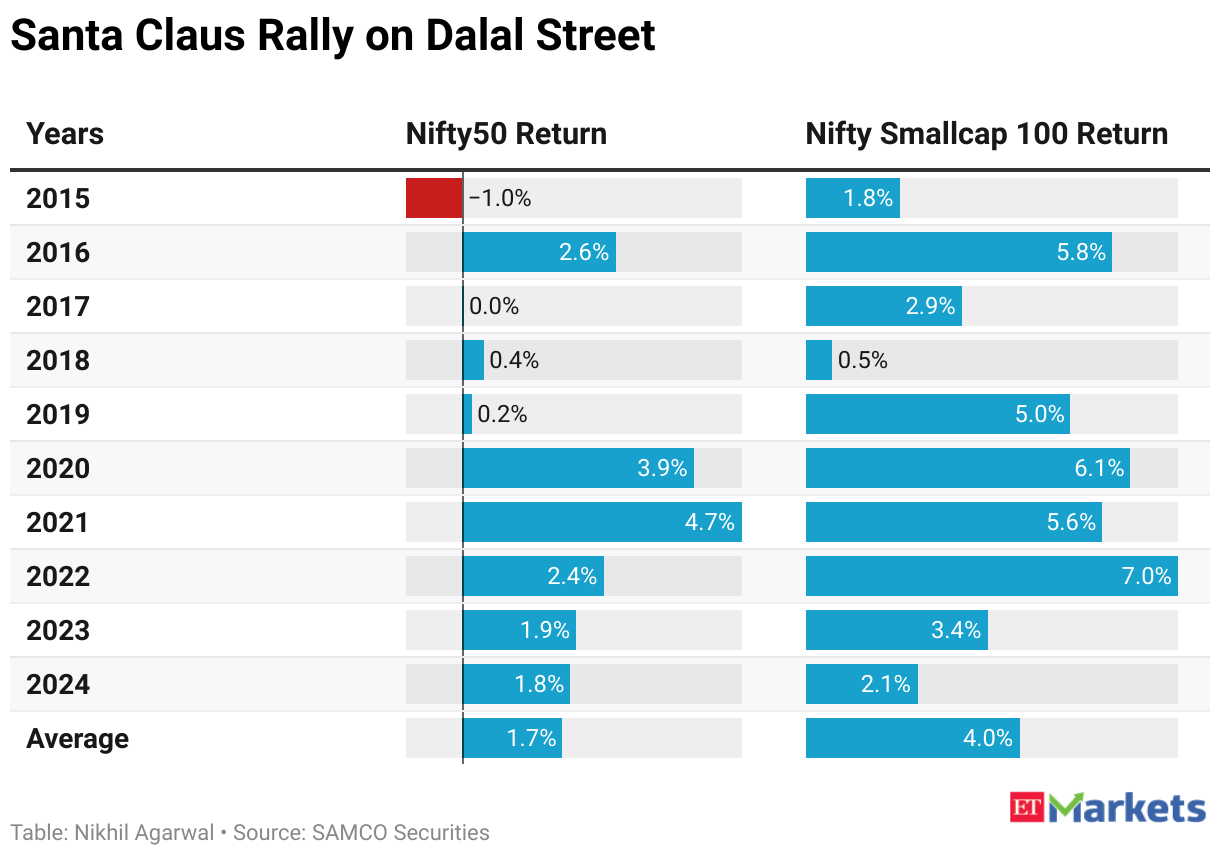

As Indian equities head into the final trading sessions of the year, the familiar question around the Santa Claus rally has resurfaced, with historical data and recent market signals pointing towards smaller stocks once again stealing the spotlight.Data from SAMCO Securities shows that smallcap stocks have delivered the strongest performance during the Santa Claus period — defined as the last five trading days of December and the first two sessions of January — over the past decade, according to an ET report. Smallcaps posted an average return of 3.55% during this window, with a 100% success rate, outperforming both midcaps and largecaps.Large-cap stocks, represented by the Nifty 100, delivered comparatively modest average gains of 1.78% over the same period, while midcaps recorded average returns of 2.63% with a 90% success rate. Importantly, downside risk across market segments has remained limited during this seasonal phase, even in weaker market years.

“Smallcaps have been the biggest beneficiaries, with an average return of 3.55% and a 100% win rate, indicating uninterrupted gains during this seasonal window,” said Jahol Prajapati, Research Analyst at SAMCO Securities. “The Santa Claus Rally is not merely a market myth but a repeatable seasonal pattern, where improved sentiment, lighter volumes, and year-end positioning create a favorable environment — especially for mid and small-cap stocks.”For the current year, analysts say technical indicators are beginning to support the case for a rebound in smaller stocks after a prolonged phase of underperformance. The Nifty Smallcap 100 index has shown what analysts describe as constructive price action, with two consecutive small-bodied candles featuring long lower shadows — a pattern suggesting buying interest on declines. This has been accompanied by a positive crossover in the daily Relative Strength Index (RSI).“The crucial level to watch is the 20-day EMA zone of 17,450–17,500. If the index sustains above 17,500, it is likely to regain strong upward momentum, potentially leading to an extended pullback toward 17,800,” said Sudeep Shah, Head of Technical and Derivatives Research at SBI Securities, quoted ET. “Given its historical Santa rally performance and the recent technical improvement, the setup favours accumulation on dips.”Market breadth indicators also suggest improving participation among smaller stocks. While 58% of Nifty constituents closed above their 10-day simple moving average this week, down from 64% in the previous week, the Nifty Smallcap 250 index saw 57% of its constituents trading above the same benchmark — a sharp rise from 39% a week earlier.“This suggests that smallcaps have begun to catch up, encouraging a stock selective approach with the smaller cap stocks in the near term,” said Anand James, Chief Market Strategist at Geojit Investments Limited.The broader Nifty index, too, is showing signs of stabilisation. After moving along a declining trendline for nearly three weeks, the benchmark has managed to hold above the previous week’s low, indicating a potential bottoming process.“The index has recently formed an Adam & Adam double bottom pattern, and the neckline resistance lies in the 26,050–26,100 zone,” Shah said. “If Nifty manages a sustained breakout above 26,100, it would confirm the pattern and could very well trigger fresh bullish momentum, aligning with the typical Santa rally behaviour.”James sees an initial upside target of 26,300 for the Nifty, though he cautioned that failure to sustain above 25,980 could result in a period of sideways consolidation instead of a sharp rally.Prajapati said the consistency of the year-end rally has been notable across cycles. “Importantly, downside risk during this period has remained limited, with minimal negative returns even in weaker years,” he said. “Overall, the chart reinforces that the Santa Claus Rally is a repeatable seasonal pattern.”(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)