Let me guess your SIP journey.You start with great enthusiasm. You’ve read about compounding, you’ve seen the long-term Sensex chart, you’ve promised yourself, “Yeh SIP toh 15 saal chalegi.” For a while, everything behaves. Markets are up, your app shows green, you feel like a genius.Then one fine day, markets start falling. Your returns go from +18% to +9%. You are uncomfortable, but okay. Then it goes to +2%. Then to –5%. Suddenly, the same SIP that made you feel smart now makes you feel stupid.And then the thought arrives: “Why am I putting good money after bad? Let me stop for now. I’ll restart when things look better.”Of course, when things “look better”, the market is already up again. You restart your SIP near the top. Next fall, repeat.If this sounds familiar, congratulations: you are completely normal and quietly sabotaging your own plan.The first thing to understand is what a SIP actually does. It does not guarantee returns. What it does is force you to buy more units when markets are down and fewer when markets are up. It only works if you let it do this job when it feels most uncomfortable.You don’t have to take my word for it. Let’s look at how SIPs behave through a bad period.

Stopping SIPs during market falls can be costly

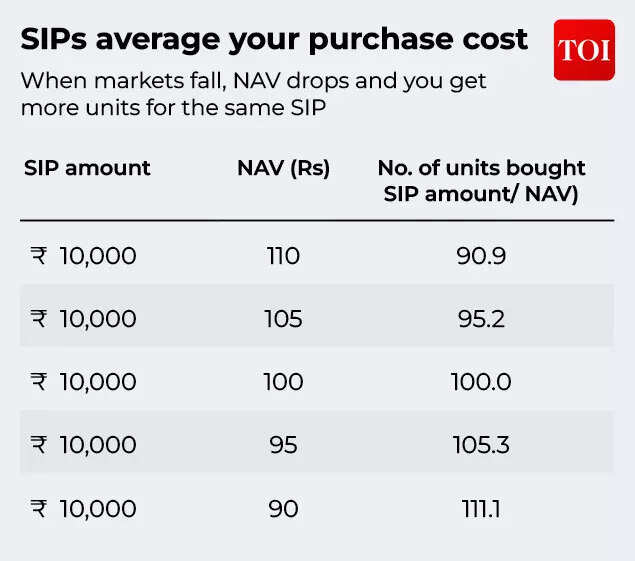

At Value Research, when we run such SIP-through-crash scenarios, the pattern is boring and brutal. The investor who continued investing during the fall usually ends up with more units at a lower average cost and a larger corpus a few years later. The investor who stopped and waited for “visibility” ended up doing the investment equivalent of buying umbrellas after the monsoon.So why do we keep stopping SIPs even when we know, at an intellectual level, that this is a bad idea?One reason is that we experience losses more strongly than gains. Behavioural economists call it “loss aversion”; in normal language, it’s just “mujhse ye nuksaan dekha nahi jaata.” A 10% fall hurts more than a 10% gain pleases us. So when you see your portfolio in red, your brain screams, “Stop the pain!” Stopping the SIP feels like doing something sensible, when in fact you’re just locking in the discomfort without getting the future benefit.Another reason is that we forget that the money going into a SIP during a crash is buying units at a discount. All we see is, “Market gir raha hai, mera paisa doob raha hai.” We don’t see, “I am picking up more of the same fund at a discount.”Here’s a small example to make that clearer.Imagine you run a SIP of ₹10,000 per month in a fund whose NAV moves like this for one year:

- Month 1: ₹100

- Month 6 (after a fall): ₹70

- Month 12 (partial recovery): ₹90

If you stop your SIP exactly when the NAV is ₹70, you are refusing to buy when it is cheapest. That is the opposite of what you would do in a sale for anything else in life.

SIPs average your purchase cost

So what can you do to stop yourself from pressing the “pause” button every time the market misbehaves?The first step is to separate your money by time. If you are using equity SIPs for long-term goals—10, 15, or 20 years away—then you should not depend on that same money for near-term emergencies or short-term needs. That is why I keep repeating the boring basics: have an emergency fund and appropriate debt or bank savings for short-term goals. At Value Research, we insist on seeing this cushion before saying, “Haan, ab equity SIP karo.” If your SIP money is truly long-term, then a bad year is a bump, not a verdict.The second step is to decide your SIPs when you are calm, and then refuse to renegotiate with your future panicked self. You can even write down a simple rule for yourself: “I will not stop my SIPs because of market levels. I will only stop if my income situation changes drastically.” Treat it like a standing instruction to yourself, not just to the bank.A third step, if you can handle it psychologically, is to flip the script. Instead of thinking, “Market gir raha hai, mera nuksaan ho raha hai,” believe, “Market is on sale, my SIP is buying more.” Some disciplined investors even increase their SIPs slightly during big falls, but that’s an advanced move. For most people, just not stopping is enough. At Value Research, when we look back at long-term SIPs—10, 15, 20 years—the thing that stands out is not the “perfect entry” or “best fund”. It is this simple question: did the investor keep going through the ugly patches, or did they cut off the SIP just when it was doing its best work?So the next time the market is falling and you feel the itch to stop your SIP, remember this: the feeling is normal, the action is costly. Your SIP does not need you to be fearless. It just requires you to avoid one specific mistake—turning it off when it is finally buying things at a discount.If you really meant it when you said “long term”, don’t let a bad year scare you out of a good plan. Close the app, let the SIP run, and give your future self a chance to be pleasantly surprised.If you have any queries for Dhirendra Kumar you can drop us an email at: toi.business@timesinternet.in(Dhirendra Kumar is Founder and CEO of Value Research)