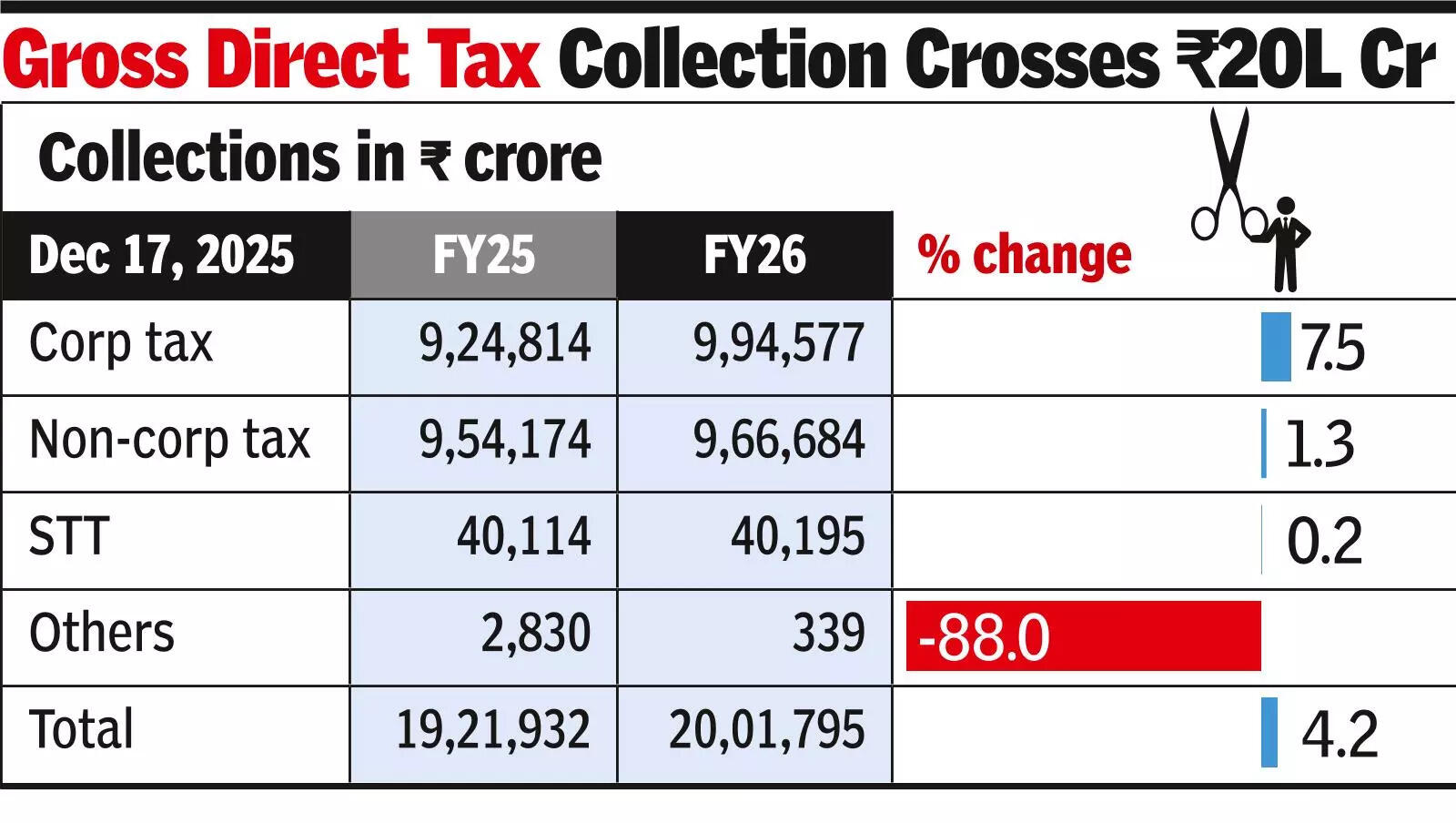

NEW DELHI: Corporation tax collections overtook the non-corporate tax mop-up, which went up 1.3%, pulling down the gross direct tax collections growth to 4.2% till mid-Dec with the overall kitty swelling past the Rs 20 lakh crore mark.Latest data released by the income tax department pegged corporation tax collections up to Dec 17 at Rs 9.94 lakh crore, 7.5% higher than a year ago, while non-corporation tax, which is personal income tax, was 1.3% higher at Rs 9.67 lakh crore.

The latest numbers came after the third instalment of advance tax payments, which showed that non-corporate tax payments fell 6.5% to Rs 1.8 lakh crore, while corporation tax was 8% higher at a little under Rs 6.1 lakh crore.“Overall, the corporate advance tax increase signals good corporate earnings. Non-corporate advance tax collections have… declined possibly on the back of rate cuts for individuals given in the previous Budget,” said Rohinton Sidhwa, partner at consulting firm Deloitte India. The bad news is that refunds fell 13.5% to a little under Rs 3 lakh crore, resulting in a 8% rise in net direct tax collections to over Rs 17 lakh crore.“A pickup in refunds would weigh on the growth in net non-corporate tax collections in the remaining part of the fiscal. Overall, ICRA expects a sizeable miss in PIT collections relative to the FY2026 Budget target of Rs 13.6 lakh crore…,” said ICRA chief economist Aditi Nayar.