By Praveen Singh2025 has been an extraordinary year for precious metals, marked by gold gaining nearly 71% and silver surging an impressive 150%. As 2025 draws to a close, it’s an ideal moment to reflect on what 2026 may hold. With strong fundamentals and deep‑rooted structural forces supporting a long‑term bullish outlook for hard assets, particularly precious metals, it is reasonable to expect that 2026 could deliver another year of substantial gains. Indeed, it wouldn’t be far‑fetched to anticipate gold and silver maintaining their strength well into the remainder of the decade. Looking for a historical parallel to today’s surge in precious metals, the current rally closely echoes the boom of the 1970s a period defined by intense geopolitical tensions, runaway inflation, and the emergence of a new monetary and financial order following the collapse of the Bretton Woods system in 1971. It is worth highlighting that despite stellar performance of the metals, both gold and silver continue to remain under owned as gold ETF share of total global ETF AUM is 2.8%, while silver ETF share is merely 0.25%; the very fact itself may serve as a positive catalyst going forward. Drivers of 2025 rally:

- Spot gold, currently at $4487, up around 71% YTD, is making 2025 its second-best year after 1979 (126%).

- The ongoing exponential rally in gold this year has been powered by a confluence of strong fundamental factors including political concerns, geopolitical tensions, concerns about the US Dollar as a global reserve currency, inflation hedging, trade wars and mounting macroeconomic worries as surging debt and reckless fiscal spending by the governments in key economies are leading to a fiscal dominant policy, which is nothing but fast-paced fiat currency debasement.

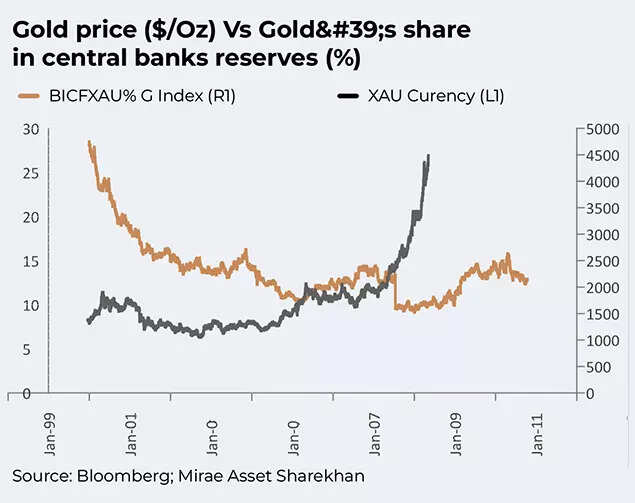

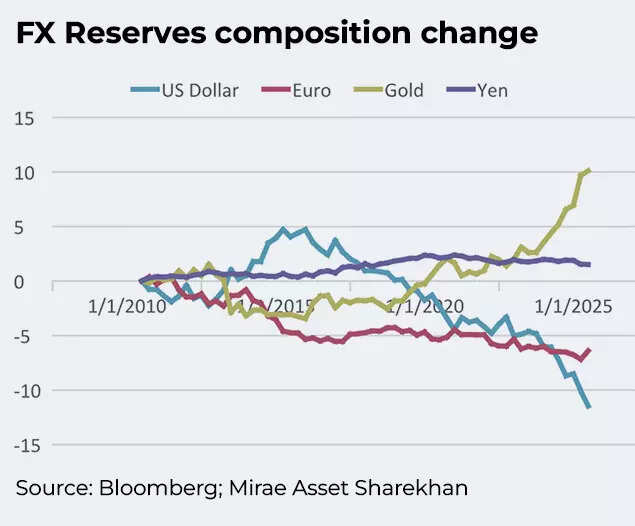

- Mounting risks to the US Dollar and US treasuries have broken the traditional relationship of gold with key drivers like US Dollar and yields. These seismic changes in the global macroeconomic and geopolitical landscapes have led to unprecedented gold buying by central banks in recent years as they diversify their forex reserves.

- The official sector, i.e., central banks, which became net gold buyers since 2009, has boosted the gold’s share in its forex reserves making the shiny metal as the second largest asset in central banks’ reserves.

Macroeconomic & policy backdrop:

- Political polarization is straining social fabric amid rising inequality.

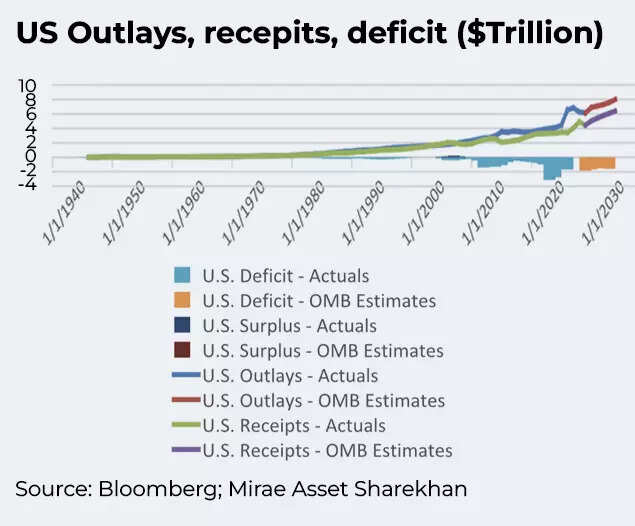

- The US fiscal deficit, at 6.1% ($1 .9 trillion) as compared to fifty-year average of 3.8%, amid unhinged government borrowing puts fiscal trajectory on an unsustainable path.

- The current debt/GDP ratio of 100% is expected to surge to 118% in 2035.

- Enormous net interest payment (NIP) load (around $1 trillion for 2025 exceeds defense spending) and sharply growing gap between revenues and outlays will lead to a cumulative fiscal deficit of around $22 trillion in 2025-2035 period. NIP/Primary deficit ratio rising to nearly 200% by then is a huge potential risk to its economic stability.

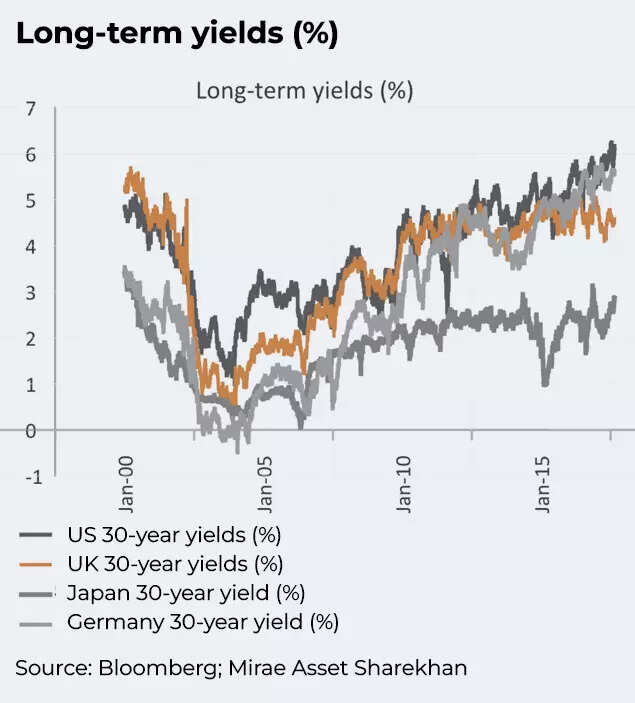

- Despite rate cuts, long-term yields are surging globally on fiscal concerns and inflationary outlook as currency debasement continues unbated reducing the purchasing power of the fiat currencies.

- Surging long-term yields may force the US Federal Reserve to go for Yield Curve Control (YCC)/quantitative easing (QE) to mitigate risks to the economy and bring down cost of interest, which will be bullish for gold and silver.

- The Fed is expected to cut rates twice in 2026 in response to weakening US job market. We think that there could be more than 2 cuts. The Fed Chair Powell at his December 10 post FOMC voiced his concern that the nonfarm payrolls could have been overstating jobs by as much as 60K since April, which means the total number 277K jobs created since April might be masking a loss of over 200K jobs.

- Trump’s tariff wars and ‘US first’ agendas make the geopolitical situation quite vulnerable and volatile amid elevated economic uncertainty, prompting nations to rethink globalization—effectively a geopolitical reset. The US and China caught up in a struggle for global supremacy will continue to support precious metals.

- Heightened geopolitical risks due to ongoing Ukraine war, volatile situation in Middle East and simmering tensions in the Caribbean due to US-Venezuela standoff will keep huge geopolitical risk premiums embedded in gold prices.

- Institutional risk is rising as political pressure on the Fed grows. With Stephen Miran, Chair of Council of Economic Advisers, on the Fed Governor Board and Kevin Hassett (a vocal proponent of lower rates) being floated as a potential successor to Powell, questions around Fed independence and inflation credibility intensify.

- As the Federal Reserve, running a fiscal dominant monetary policy, cuts rates into elevated inflation and normalizes 3% inflation, its credibility to contain inflation is being questioned, more so as the Fed’s independence faces political threat.

- The US Dollar Index, already down 10% YTD, faces further losses due to huge US twin deficits, diversification, loose monetary policy and the US government’s intent to weaken the Dollar to support the hollowed-out US manufacturing sector, a deeply politicized subject.

- China and Europe, sensing an opportunity in the Dollar woes, continue to promote their currencies. We are also seeing increased bipartite/regional trade deals which will further erode the US Dollar’s role in global trade.

- It is to be noted that fiscal worries and inflation concerns are visible in key economies like Japan, China, UK, etc. as well, so it is not merely a US-centric phenomenon. As government bonds face downside pressure, it is expected that the traditional 60:40 portfolio will change soon to accommodate precious metals also.

Positioning & flows:

- AI-led lofty equity valuation and ROI concerns add to gold’s appeal.

- Global gold ETF holdings of ~98.41 Moz are up ~18.7% YTD (+484t), the highest since Sep-2022. 2025 net inflows are the strongest since 2009 (644t); all-time high is 111.25 Moz (15 Oct 2020).

- Central-bank reserves: gold’s share is ~28%, second after US Dollar and near 3-decade high.

- The yellow metal’s share is reportedly above US treasuries for the first time since 1996.

- Gold’s share in global FX reserves has nearly tripled since the 2007–08 crisis; with gold’s share near 75% in the 1980s, there remains ample runway for official sector buying.

View and target:

- I remain constructive on gold and look for a target of $5000 in 2026. There is an upside risk to the target though.

Silver: moving out of gold’s shadow

- Silver has stepped out of the shadows of the yellow metal as it builds on the gold rally with an enormous momentum.

- The grey metal, currently at $72.33, has surged 150% YTD.

Fundamentals:

- Strong bullish underpinnings rooted in green energy transition, AI and new demand sources like nuclear reactors, medical devices, defense technologies, etc. support our bullish thesis with industrial demand at a record high.

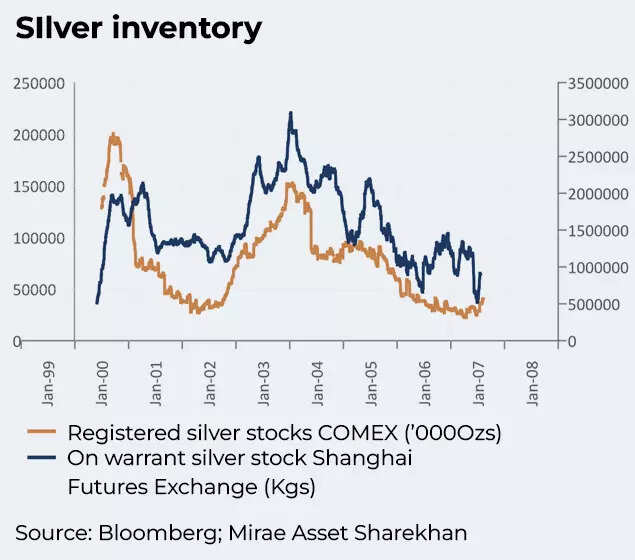

- The metal is deriving its strength from tight inventory too as investors pile into the metal on its relatively cheaper valuation as compared to gold. In addition, strong ETF demand for silver has been resulting in inventory dislocation and tight inventory also, which is also a huge catalyst for silver rally.

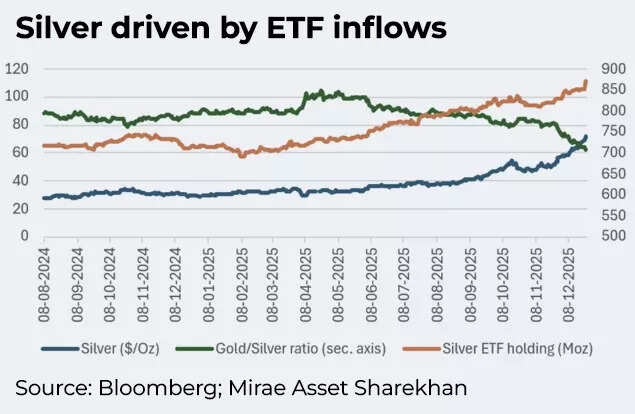

- Gold/Silver ratio, which surged to 105 in the wake of ‘Liberation Day’ shock in April, has plummeted to 62 as silver caught up with gold rally.

- The silver market, currently in the fifth consecutive year of deficit, is expected to be in deficit in 2026, too.

- Supply crunch has been felt in India, China and most notably in the LBMA market. One-month LBMA silver lease rate at 6% is at the highest since October 23 and is well-above the historical lease rate of 0.3%-0.5%.

Flows & positioning:

- Silver ETF holdings of ~871 Moz are up ~21% YTD, the highest since June 2022.

- Net inflows of ~4820 tons YTD are the strongest since 2020 (8,802t), and ETF holdings could surpass the 2021 peak (~1.02B oz).

Policy tailwinds to be supportive:

- Possibility of QE/yield curve control in the US and stimulus in Germany, China, and the US should reinforce the demand for the metal.

View and target:

- I continue to remain constructive on the grey metal and expect it to reach ~$85-$95 in 2026. At the same time, given that ~70% of silver demand is industrial, price action at times may be volatile sensitive to monetary policy, broader market corrections, and macro shifts.

Is it too late to start investing in precious metals?

- It’s a natural question especially after the meteoric rallies in gold and silver. Despite their strong performance, our long‑term outlook still sees gold eventually moving into the $6,500–$7,000 range, while silver could advance toward $125 by the end of the decade.

- Given this trajectory, it’s not too late for investors who may have missed the earlier upswings. Beginning to build exposure now through a systematic, disciplined investment approach can still position portfolios to benefit from the structural strength underpinning precious metals over the long term.

(Praveen Singh is Head of Commodities and Currencies, Mirae Asset ShareKhan)(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)