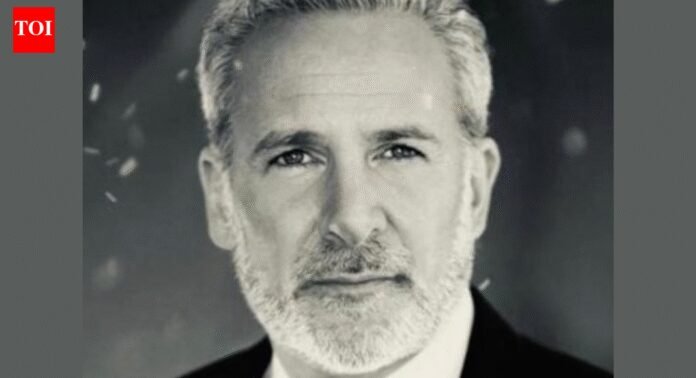

Economist Peter Schiff, renowned for predicting the 2008 financial crisis, advised investors to buy gold while being cautious with silver. He believes gold is a bargain at $4,534 with minimal downside risk, while silver faces higher short-term risks despite its strong performance in 2025. Schiff recommended waiting for a consolidation in silver and recommended a possible support level between $70 and $75.The chief economist at Europac mentioned silver’s volitality, talking about how it hit a record high near $84 before dropping to $75 and then rebounding above $80. “It’s been a volatile night so far in the silver market. After surging to a new record high just below $84, silver sold off sharply, finding support just above $75. It has since recovered and is now trading back above $80. This historic bull market still has a long way to run,” Schiff said on X.Also telling people to buy gold over silver he added, “There is too much short-term risk to buy physical silver now. But I’m not selling any of mine. So I think it makes sense to wait for it to settle down before buying. But absolutely buy gold right now. At $4,534 it’s a steal.”Recent market activity shows precious metals pulling back as investors took profits and geopolitical tensions eased. Gold dropped 0.4 per cent to $4,512.74 per ounce after reaching a record $4,549.71. Silver fell 1.3 per cent to $78.12 per ounce, following its all-time high of $83.62.Despite the current dip, silver has been the star performer of the year, surging 181 per cent year-to-date compared to gold’s 72 per cent increase.Even after this current correction in the price, silver has been the biggest star this year, with a year-to-date increase of 181 per cent compared to gold’s 72 per cent. For gold, the drivers of the surge are expected rate cuts by the US, geopolitical turmoil, robust demand by central entities, and investments by ETFs. For silver, the drivers are the metal’s importance to the US, lack of supply, and growing demand.(Disclaimer: Recommendations and views on the stock market and other asset classes given by experts are their own. These opinions do not represent the views of The Times of India)