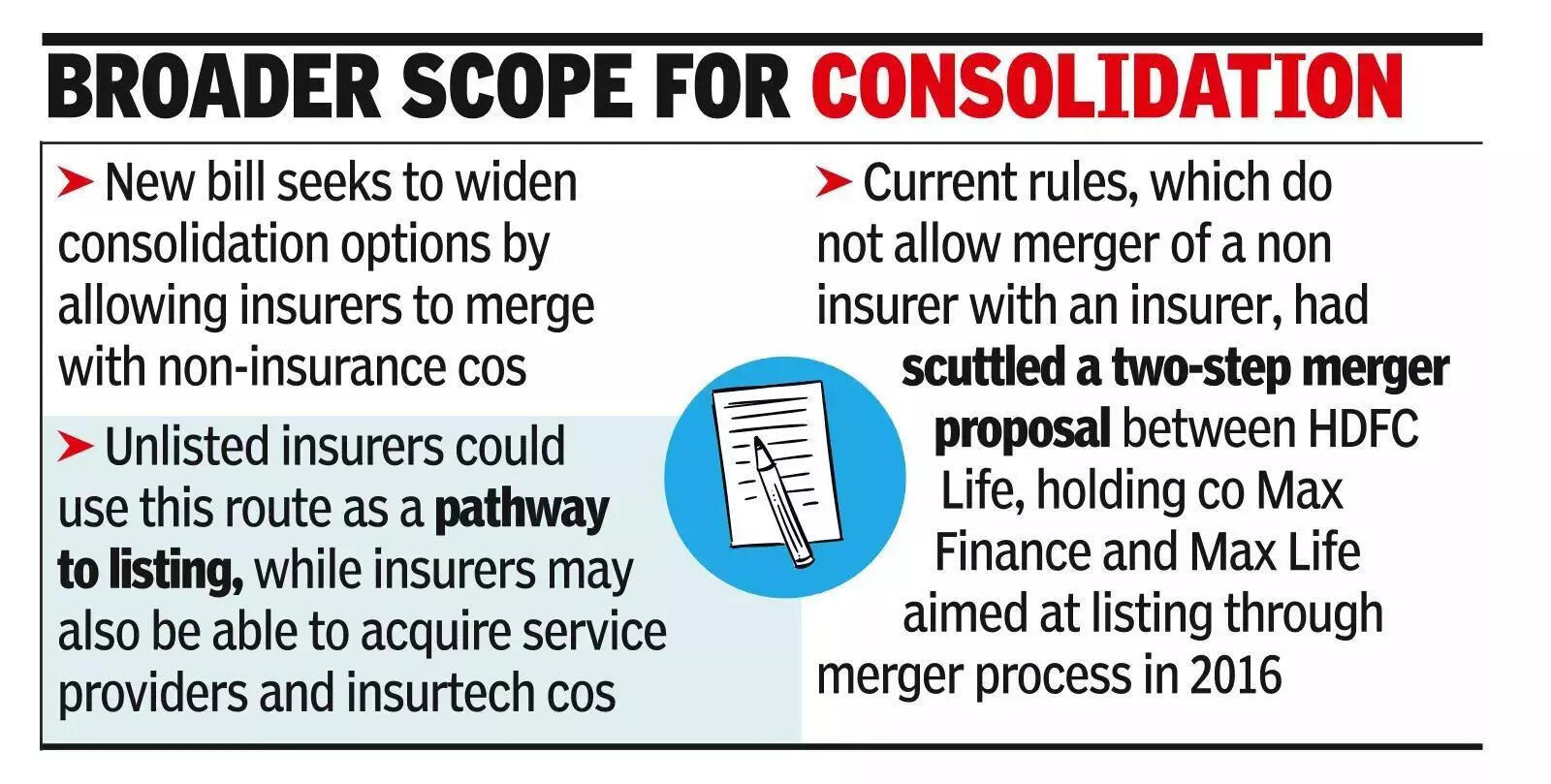

MUMBAI: The amendment to insurance laws is expected to trigger a fresh round of consolidation and deal-making in the sector, alongside new capital inflows following govt’s decision to permit 100% foreign direct investment.Apart from opening the door to higher foreign ownership, the new bill seeks to widen consolidation options by allowing insurance companies to amalgamate with non-insurance companies through a scheme approved by regulator Irdai. This change could create new listing routes for insurers and expand acquisition opportunities beyond insurer-to-insurer mergers.According to Shivangi Sharma Talwar, partner at JSA Advocates and Solicitors, the amendments could materially alter the legal framework governing mergers in the sector. “With the amendments proposed under the new insurance bill, it may become legally permissible for an insurer to amalgamate with a non-insurance entity, provided the scheme results in an insurance company as the surviving or resultant entity,” she said.

She added that the impact will depend on regulations yet to be notified, particularly on the scope of non-insurance activities insurers may be allowed to undertake. Subject to regulatory clarity, unlisted insurers could use this route as a pathway to listing, while insurers may also be able to acquire service providers and insurtech companies, broadening the scope for consolidation in the sector. The framework could also allow insurance companies to acquire other businesses, including service providers and insurtech companies, expanding consolidation beyond traditional insurance-to-insurance mergers.The proposed change flows from clause 33 of the bill, states that no insurance or non-insurance business can be transferred or amalgamated with the insurance business of another insurer except under a scheme approved by the authority, and only if the transferee continues to comply with the Act and related regulations at all times. Present rules, which do not allow merger of a non insurer with an insurer, had scuttled a two-step merger proposal between HDFC Life, holding company Max Finance and Max Life aimed at listing through merger process in 2016. This route will now be open for insurers. In practical terms, this allows a non-insurance company to merge its business with an existing insurer, provided the resultant entity remains an insurance company and the transaction is cleared by Irdai. Industry experts expect the changes to support growth and deepen the market. Shruti Ladwa, partner and insurance leader at EY India, said the amendments would “catalyse the next phase of growth by attracting global capital and advanced underwriting expertise, strengthening domestic reinsurance capacity, and insurance penetration.”