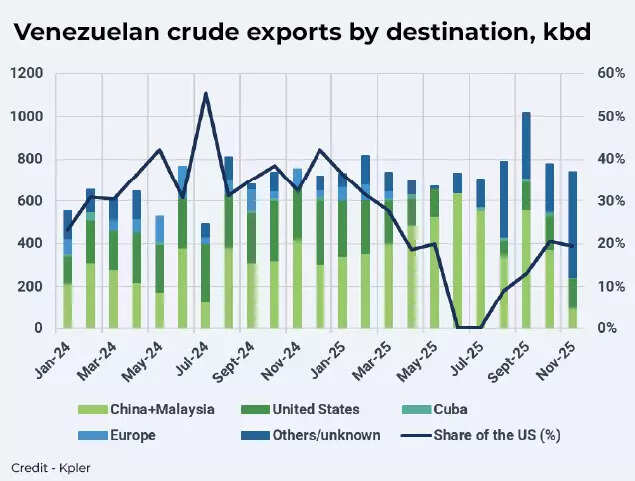

US President Donald Trump’s latest escalation in tensions and blockade of Venezuela oil tankers may have little impact on the global crude oil market, believes global real-time data and analytics provider Kpler. “The move has so far failed to provide a meaningful boost to oil prices or to overturn underlying fundamentals, largely because the market is two-tiered and even the sanctioned segment remains crowded,” says Kpler in its latest report.In 2025, Venezuela is producing approximately 900,000 barrels per day (kbd) of crude oil and condensate, which makes up about 1% of the global oil supply. Of the 765,000 barrels per day that Venezuela exports, around 76% is sent to China, specifically to independent refiners known as teapot refiners. This is because state-owned companies are avoiding these shipments due to concerns over sanctions. The United States has received about 17% of Venezuela’s exports this year, a decrease from 35% in 2024, following changes to Chevron’s license. The rest of the exports are sent to Cuba and a few other countries like Spain and Italy under previous agreements.

Trump Move On Venezuela Oil

On Tuesday, Trump announced a “blockade” on all sanctioned oil tankers traveling to and from Venezuela. This move is part of America’s ongoing efforts to increase pressure on Nicolas Maduro’s government by targeting its primary revenue source.Details on how Trump plans to enforce this blockade on the sanctioned vessels remain unclear. It is also uncertain whether he will deploy the Coast Guard to intercept these ships. The Trump administration has already positioned thousands of troops and nearly a dozen warships, including an aircraft carrier, in the region.Trump said on Truth Social, “For the theft of our Assets, and many other reasons, including Terrorism, Drug Smuggling, and Human Trafficking, the Venezuelan Regime has been designated a FOREIGN TERRORIST ORGANIZATION. Therefore, today, I am ordering A TOTAL AND COMPLETE BLOCKADE OF ALL SANCTIONED OIL TANKERS going into, and out of, Venezuela.”

Venezuela crude exports by destination

What Does It Mean For Global Crude Oil Market?

The increased US pressure on Venezuela might have added some geopolitical risk to Brent crude prices. However, this is unlikely to significantly change overall market sentiment, says Kpler. The reason is simple: disruptions to Venezuelan supply impact only a small group of buyers, and the global market is well-supplied to handle any potential shortages from US actions.Trump’s statement about blocking “all sanctioned oil tankers” suggests that shipments considered legitimate, such as those going to the US under Chevron’s license, might continue without disruption. This indicates that Venezuelan oil supplies to sanctioned markets could face interruptions, while shipments to the US would likely remain unaffected, points out Kpler. However, cargoes headed to China and Cuba could be hit. According to data from Kpler, Cuba imports about 28,000 barrels per day of crude oil in 2025, with roughly 35% coming from Venezuela. Most of the rest is supplied by Mexico, with Russia and Algeria each providing one shipment.If Venezuela’s supply becomes unreliable, Cuba might see immediate challenges. However, with the availability of Russian oil—despite recent US sanctions on Rosneft and Lukoil—Cuba could potentially look to Russia to make up for any shortfall.

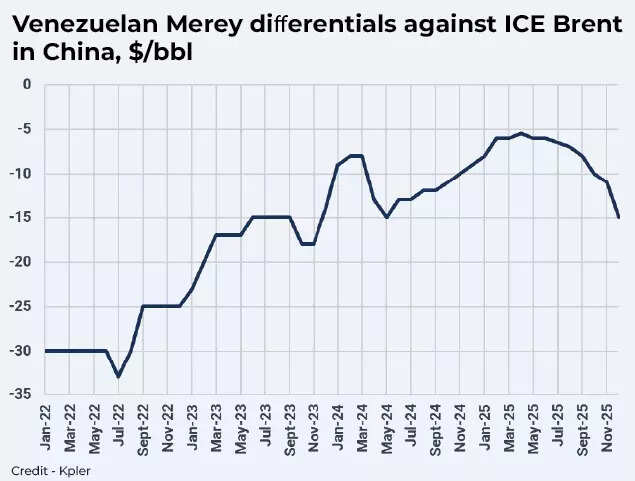

Venezuelan Merey differentials against ICE Brent in China

Chinese teapot refiners are likely to feel the effects of any oil blockade due to their reliance on Venezuelan crude. However, the impact of shipment disruptions is expected to be lessened by the high volumes of Venezuelan oil currently in transit and the ample supply from Iran, Russia, and other non-sanctioned producers, says Kpler.Market sources quoted in the Kpler report indicate that prompt Venezuelan Merey cargoes are trading at about $15 below ICE Brent on a delivered China basis, even after the US seized a Venezuelan oil tanker last week. Sellers have attempted to raise prices to around $13 below ICE Brent, but the abundant Iranian supply and a sharp drop in Russian oil prices in China have kept Venezuelan prices from rising.Many Iranian heavy cargoes, such as Pars (around $12.5 below ICE Brent) and Iran Heavy (around $11.5 below ICE Brent), remain unsold, which is likely to limit any increase in Venezuelan prices in China. Both the sanctioned and non-sanctioned oil markets are experiencing a significant supply surplus, with buyers becoming less sensitive to geopolitical developments.According to Kpler data, the floating storage of Iranian, Venezuelan, and Russian crude oil has reached a combined 74 million barrels this week, the highest level since November 2022.